Chief Financial Officer Resume

Example, Template & Expert Tips 2026

Updated on February 8, 2026.

Write a CFO resume that lands interviews in 2026: structure, ATS keywords, quantified achievements, and examples to prove board impact.

Chief Financial Officer Resume Templates

8 Templates available

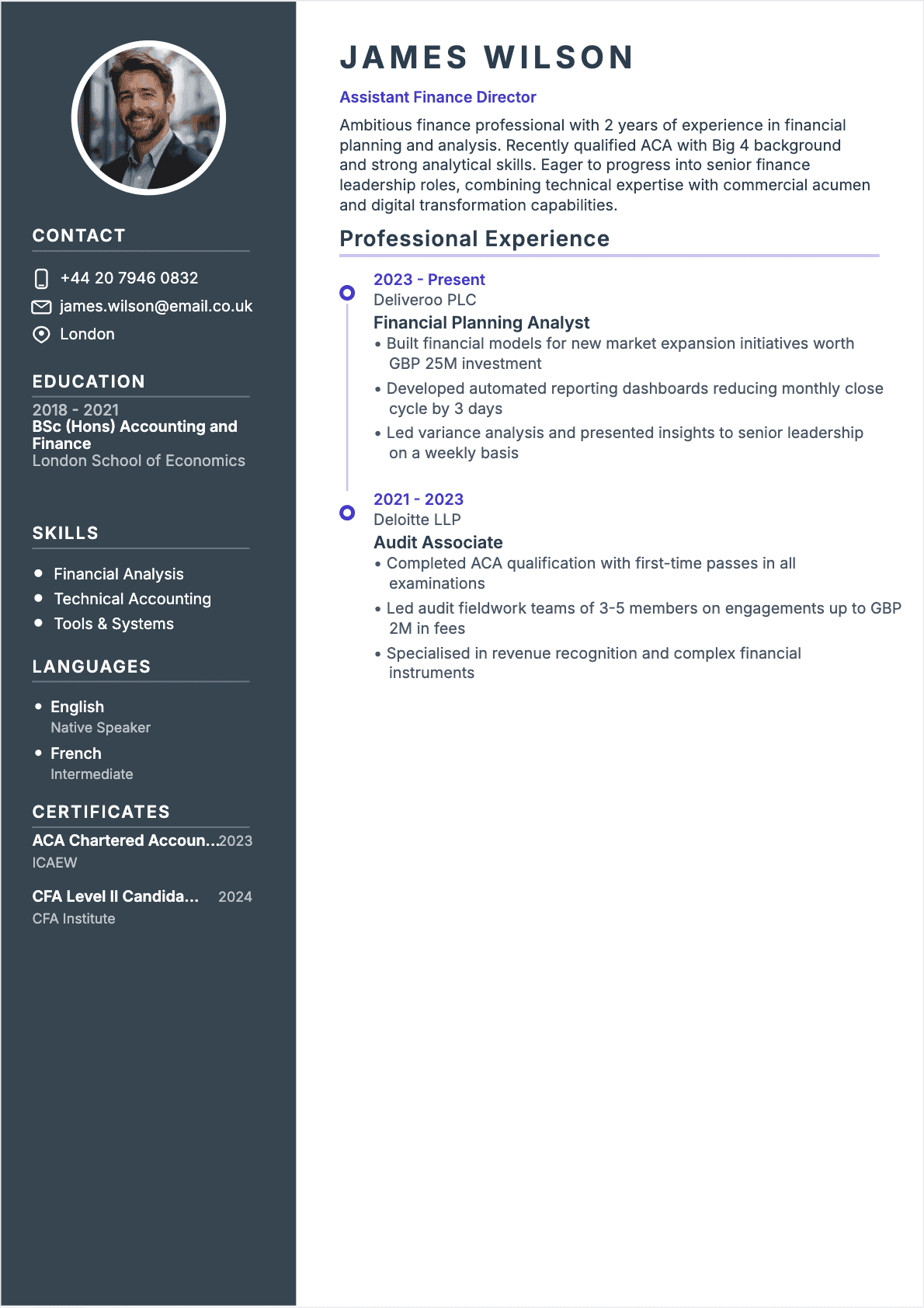

Resume Chief Financial Officer Junior

Chief Financial Officer resume template for Junior profile

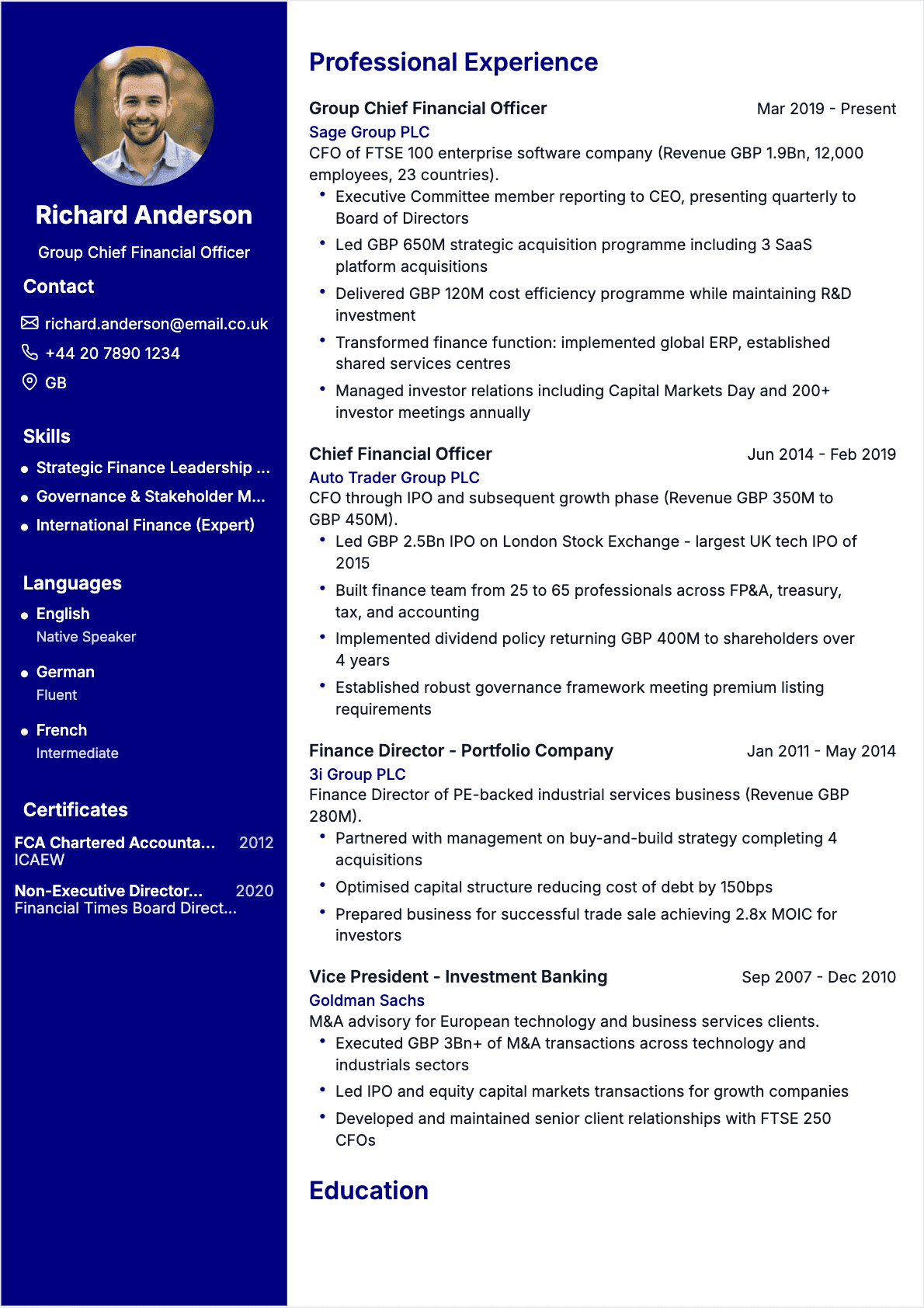

Resume Chief Financial Officer Senior

Chief Financial Officer resume template for Senior profile

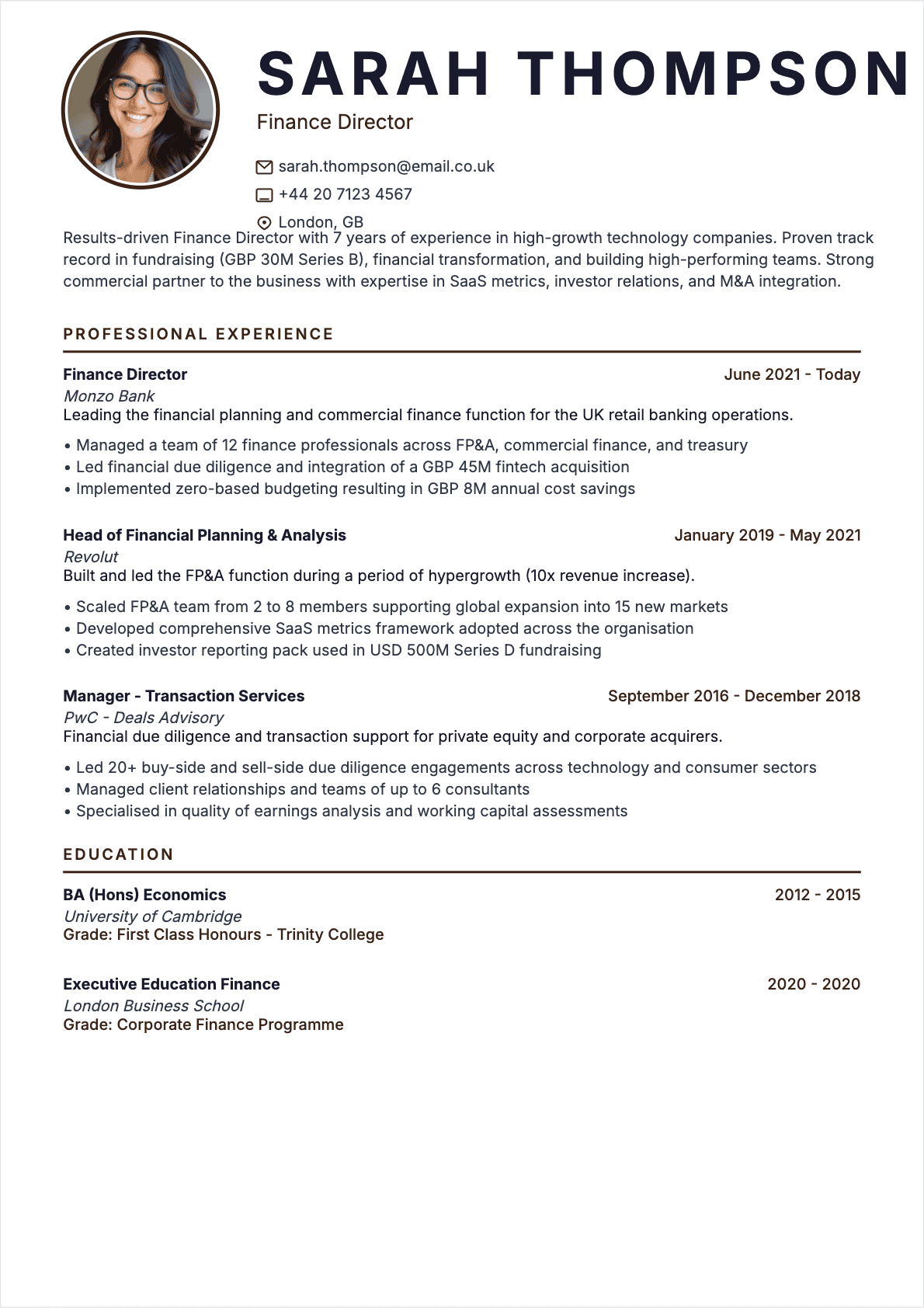

Resume Chief Financial Officer Confirmé

Chief Financial Officer resume template for Confirmé profile

Resume Chief Financial Officer Confirmé

PopularChief Financial Officer resume template for Confirmé profile

Resume Chief Financial Officer Confirmé

Chief Financial Officer resume template for Confirmé profile

Resume Chief Financial Officer Confirmé

Chief Financial Officer resume template for Confirmé profile

Like one of these Chief Financial Officer resume templates?

Select it, fill in your details and download your resume as PDF.

Chief Financial Officer Resume Examples

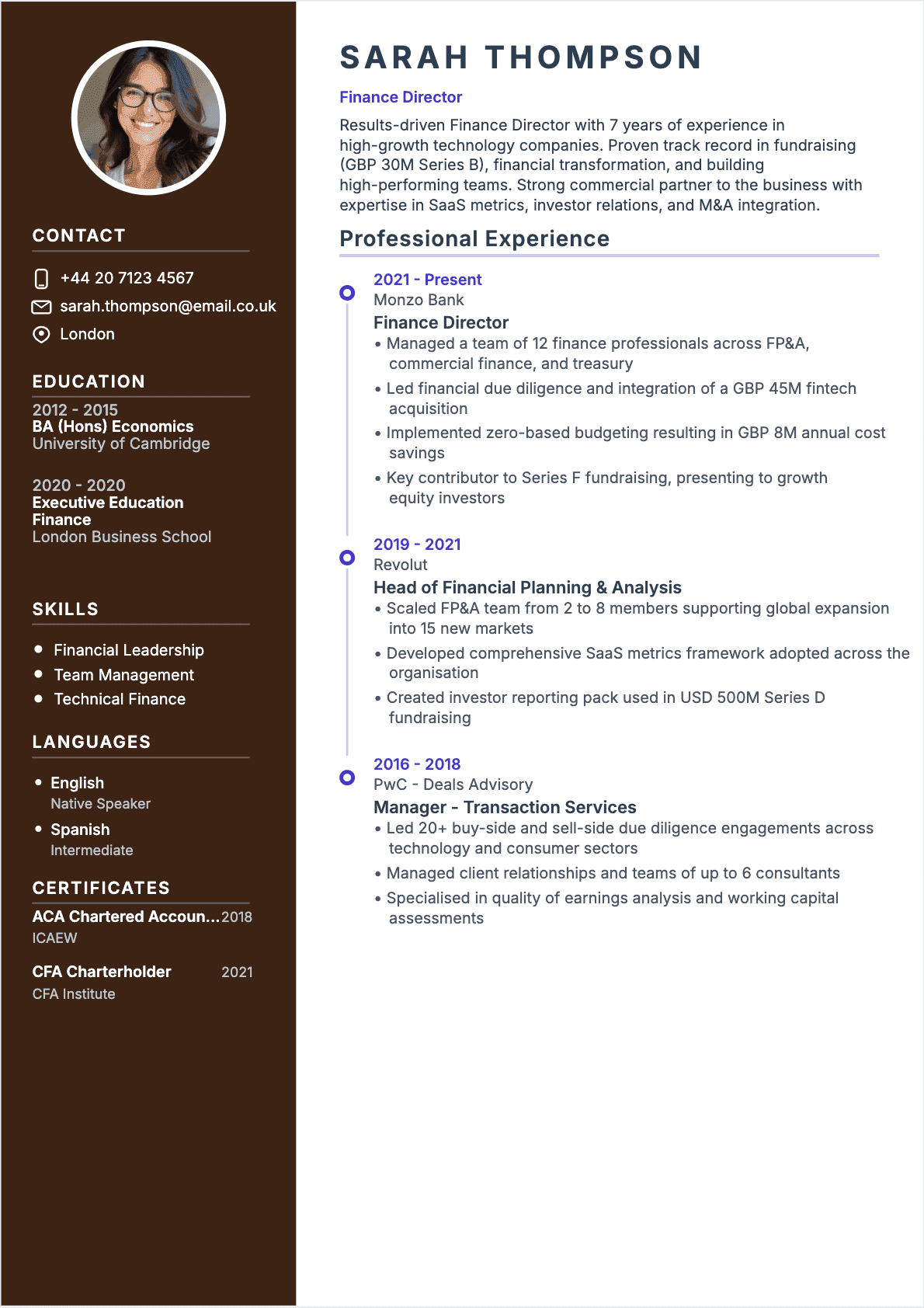

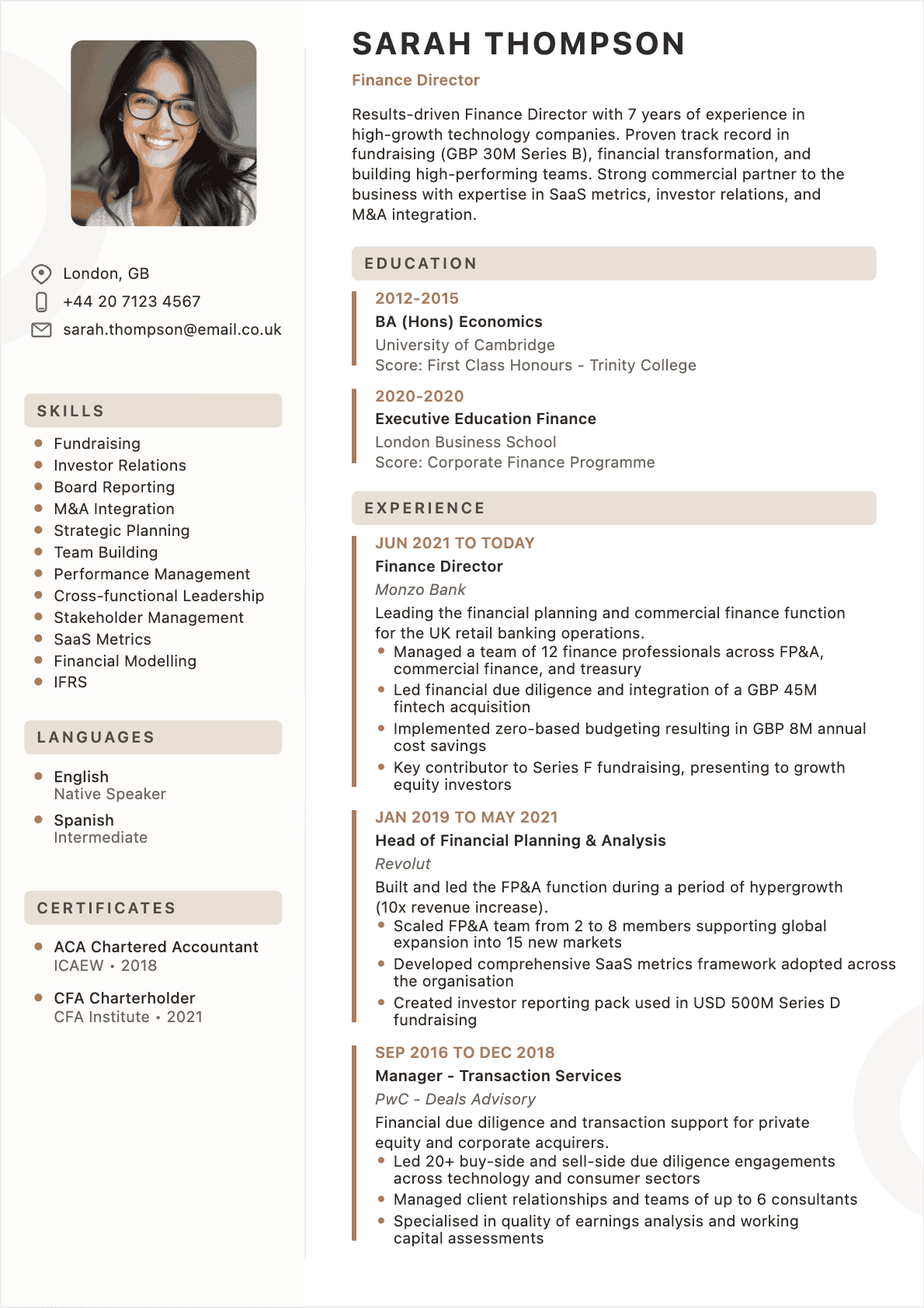

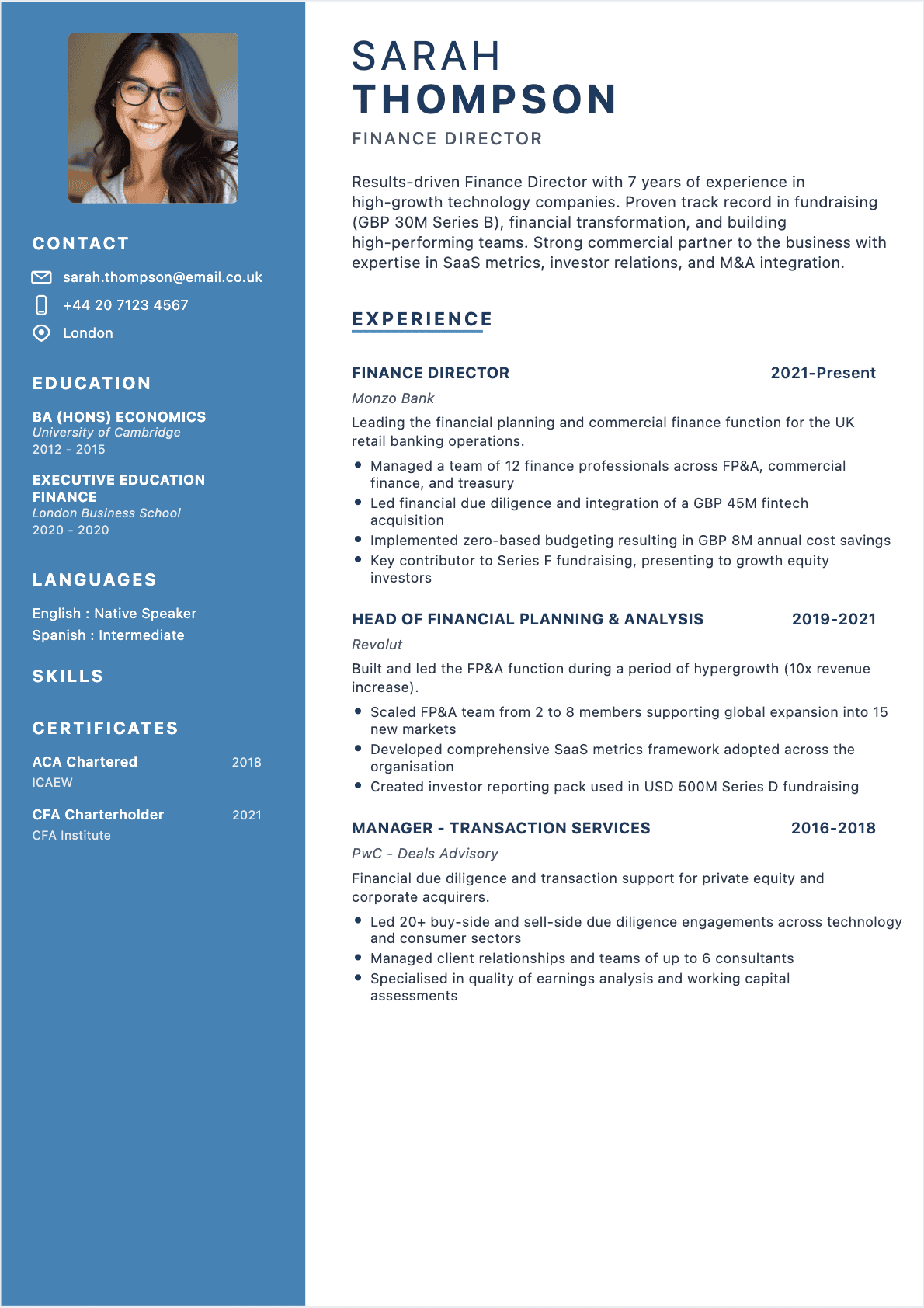

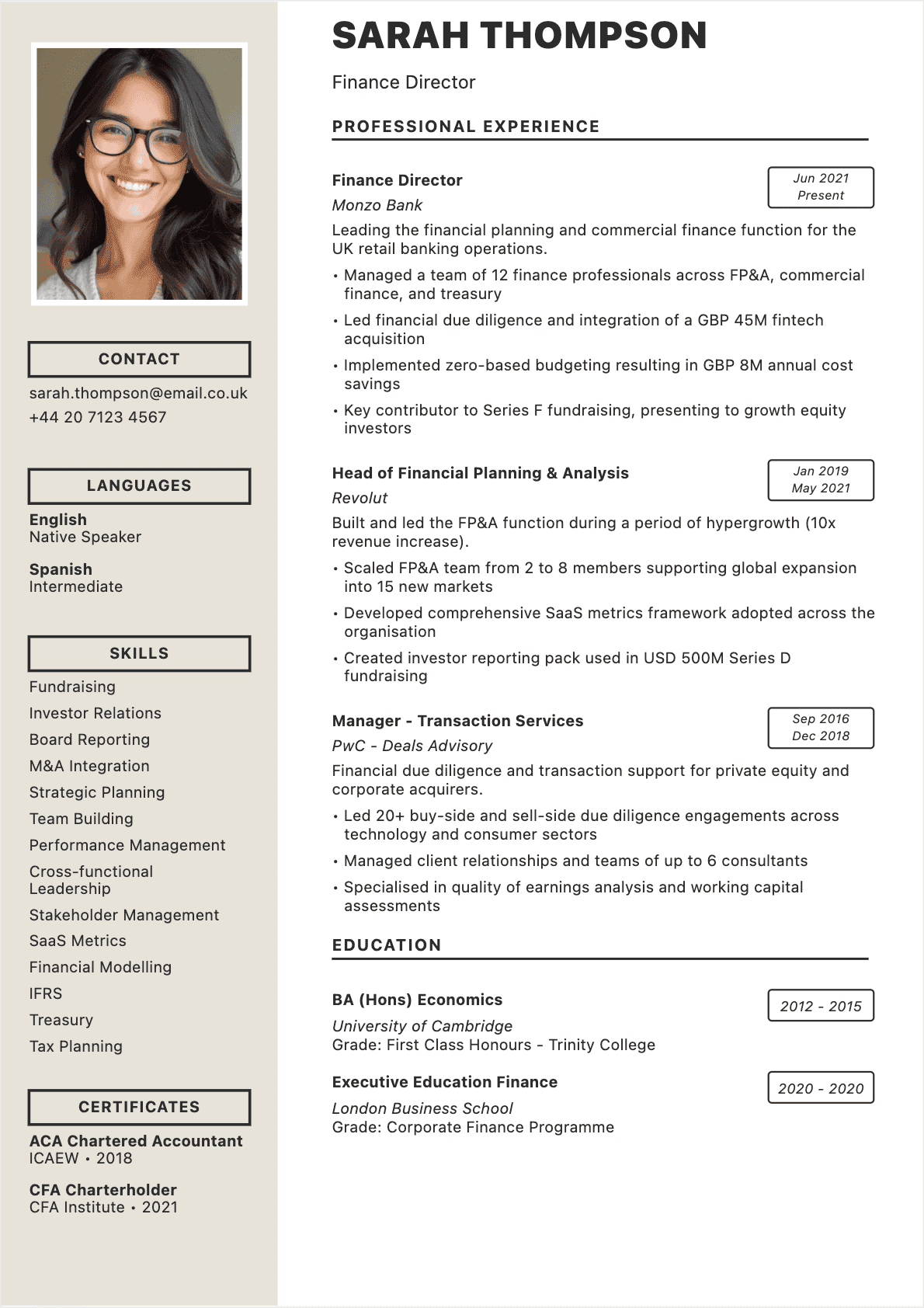

Sarah Thompson

Finance Director

sarah.thompson@email.co.uk

+44 20 7123 4567

London, GB

Results-driven Finance Director with 7 years of experience in high-growth technology companies. Proven track record in fundraising (GBP 30M Series B), financial transformation, and building high-performing teams. Strong commercial partner to the business with expertise in SaaS metrics, investor relations, and M&A integration.

Work Experience

Finance Director

Monzo Bank

- ●Managed a team of 12 finance professionals across FP&A, commercial finance, and treasury

- ●Led financial due diligence and integration of a GBP 45M fintech acquisition

- ●Implemented zero-based budgeting resulting in GBP 8M annual cost savings

Head of Financial Planning & Analysis

Revolut

- ●Scaled FP&A team from 2 to 8 members supporting global expansion into 15 new markets

- ●Developed comprehensive SaaS metrics framework adopted across the organisation

- ●Created investor reporting pack used in USD 500M Series D fundraising

Manager - Transaction Services

PwC - Deals Advisory

- ●Led 20+ buy-side and sell-side due diligence engagements across technology and consumer sectors

- ●Managed client relationships and teams of up to 6 consultants

- ●Specialised in quality of earnings analysis and working capital assessments

Education

BA (Hons)

University of Cambridge

Executive Education

London Business School

Skills

Languages

English — Native Speaker

Spanish — Intermediate

Certifications

ACA Chartered AccountantICAEW

CFA CharterholderCFA Institute

Further reading:

Frequently asked questions

Find answers to the most frequently asked questions.

In most markets, a CFO CV should be two pages to cover scope, governance, and value creation without compressing key numbers. Use page one for headline, top achievements, and the most recent roles. Page two can hold earlier leadership roles, education, and certifications. Keep it skimmable: 4–6 bullets per role, each with a metric.

Prioritize metrics that reflect the CFO mandate: cash (DSO/DPO, working capital, FCF, runway), profitability (gross margin, EBITDA, cost-to-serve), predictability (forecast accuracy, variance), governance (close days, audit adjustments), and capital structure (debt size, interest savings, covenant headroom). Tie each metric to your actions and timeframe.

You can still show board-adjacent work: preparing monthly packs for the CEO and investors, leading audit committee materials, presenting KPIs in QBRs, or running lender update calls. Write it explicitly: “Produced monthly investor pack for PE sponsor,” “Presented forecast scenarios to CEO/CRO,” or “Led annual audit planning with Big 4.” Add outcomes like faster decisions or reduced surprises.

Yes, but keep it outcome-focused. Mention the standard and what it enabled: audit quality, revenue recognition compliance, consolidation accuracy, or reduced adjustments. Example: “Owned IFRS reporting across 6 entities; reduced audit PBC turnaround from 10 to 6 days.” Avoid deep standards references unless the job is heavily technical (public company, complex revenue).

Highlight value creation and reporting cadence: weekly cash reporting, 13-week cash flow, working-capital actions, pricing/margin analytics, and rapid close. Add terms like “covenant compliance,” “run-rate EBITDA,” and “data-room readiness.” Quantify levers (e.g., DSO -14 days, EBITDA +320 bps) and show speed of execution (e.g., ERP rollout in 7 months).

No. Prioritize the last 10–15 years and the roles that demonstrate CFO readiness: controllership, FP&A leadership, treasury, or multi-entity oversight. Older roles can be summarized in a short “Earlier experience” section with 1–2 lines each. The goal is clarity and relevance, not completeness.

Your career deserves a better resume

With CVtoWork, select a template, fill in the fields and download your resume as PDF.

Start creating