Accountant Resume

Example, Template & Expert Tips 2026

Updated on February 8, 2026.

Write a CV Accountant CV that passes ATS: strong summary, quantified achievements, accounting keywords, skills, tools, and real examples to get interviews.

Accountant Resume Templates

8 Templates available

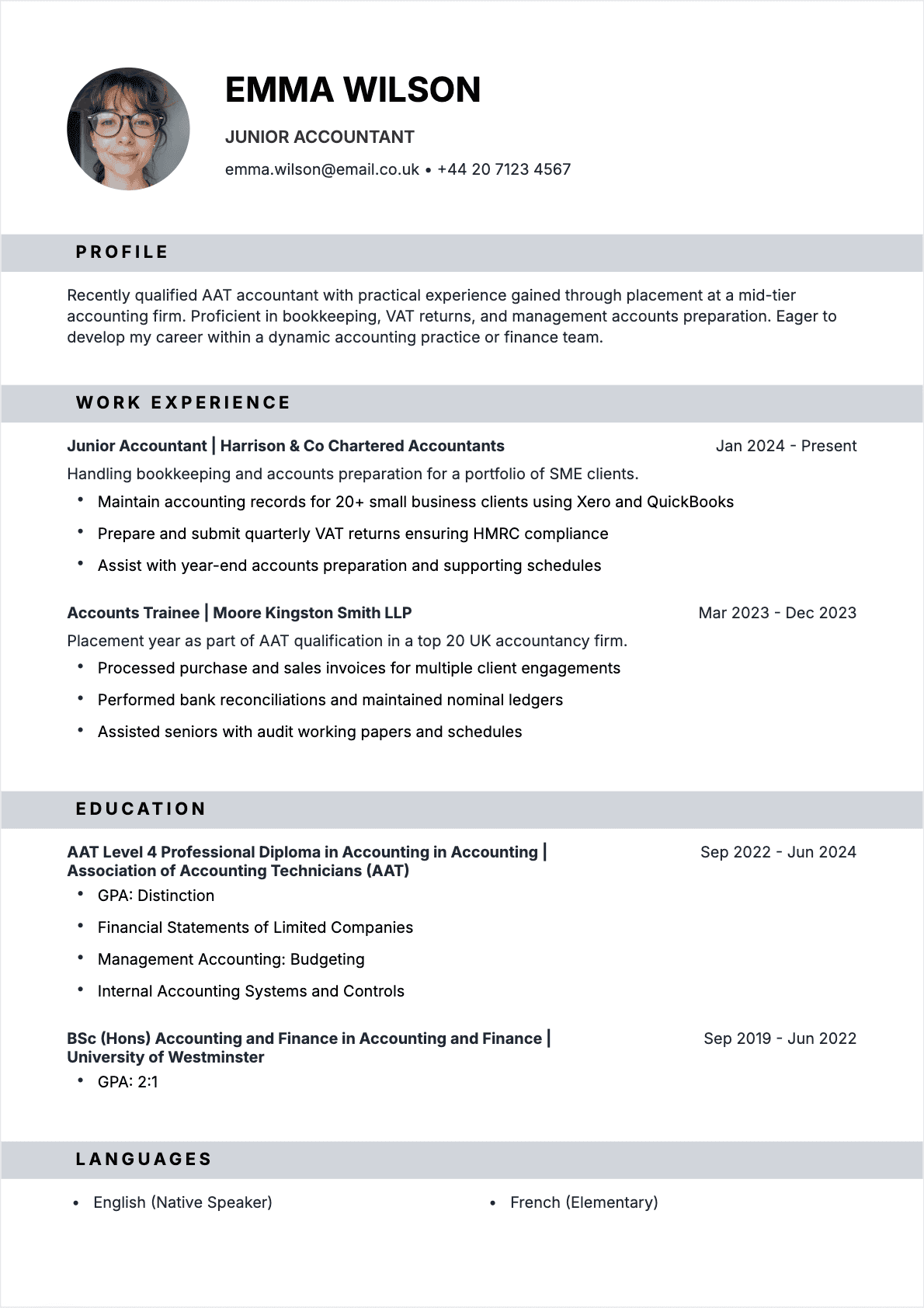

Resume Accountant Junior

Accountant resume template for Junior profile

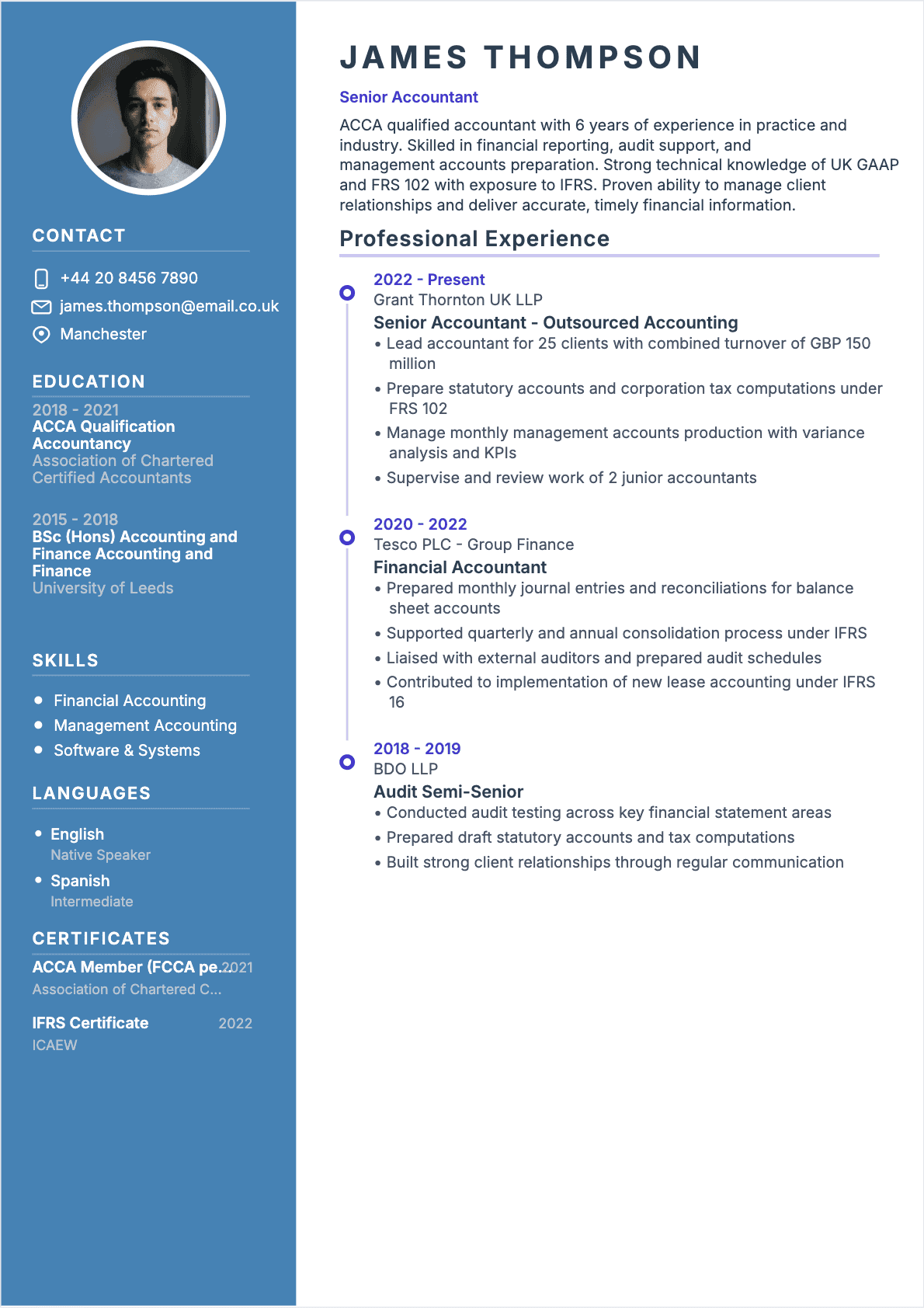

Resume Accountant Senior

PopularAccountant resume template for Senior profile

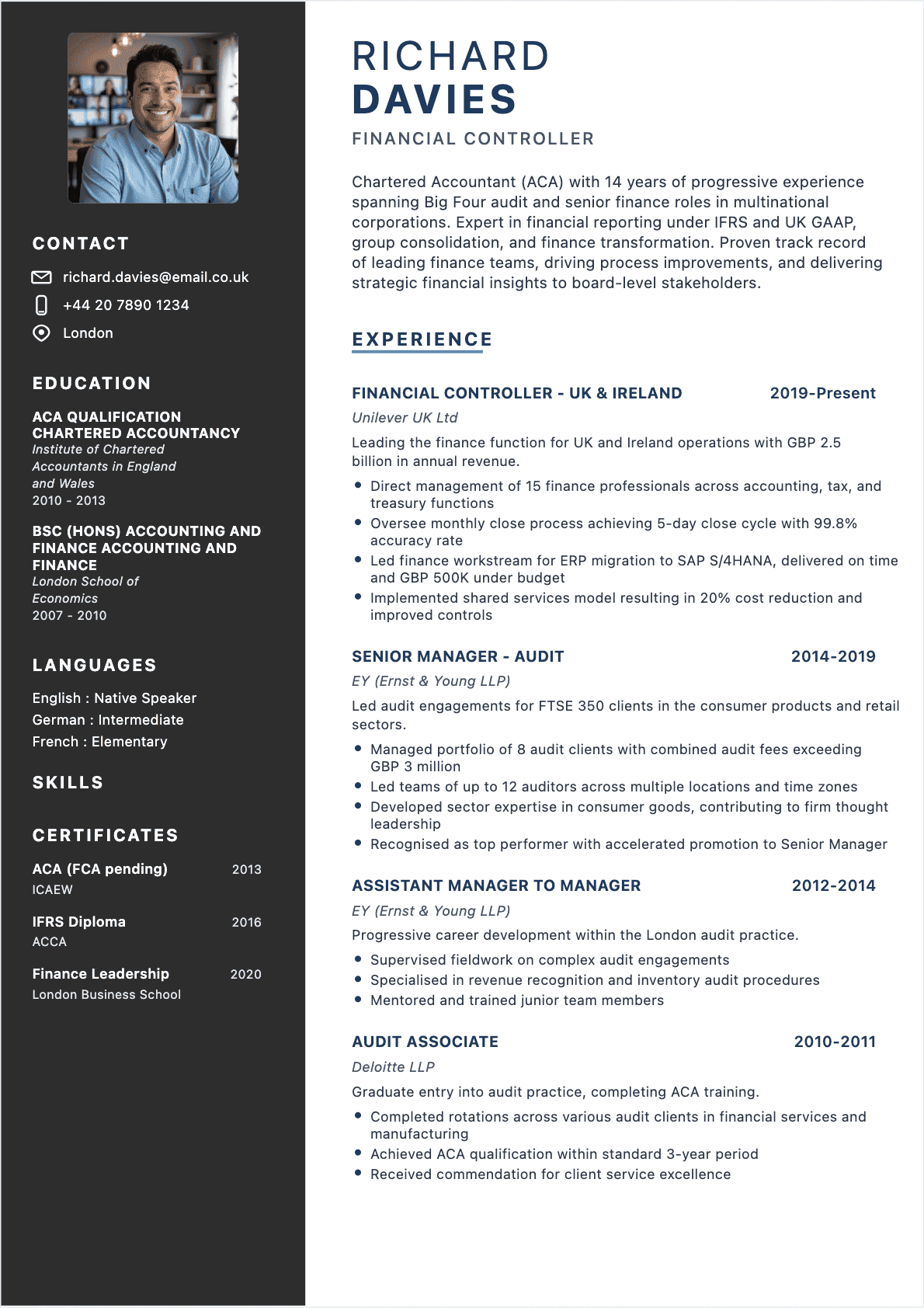

Resume Accountant Confirmé

Accountant resume template for Confirmé profile

Resume Accountant Confirmé

Accountant resume template for Confirmé profile

Resume Accountant Confirmé

Accountant resume template for Confirmé profile

Resume Accountant Confirmé

Accountant resume template for Confirmé profile

Like one of these Accountant resume templates?

Select it, fill in your details and download your resume as PDF.

Accountant Resume Examples

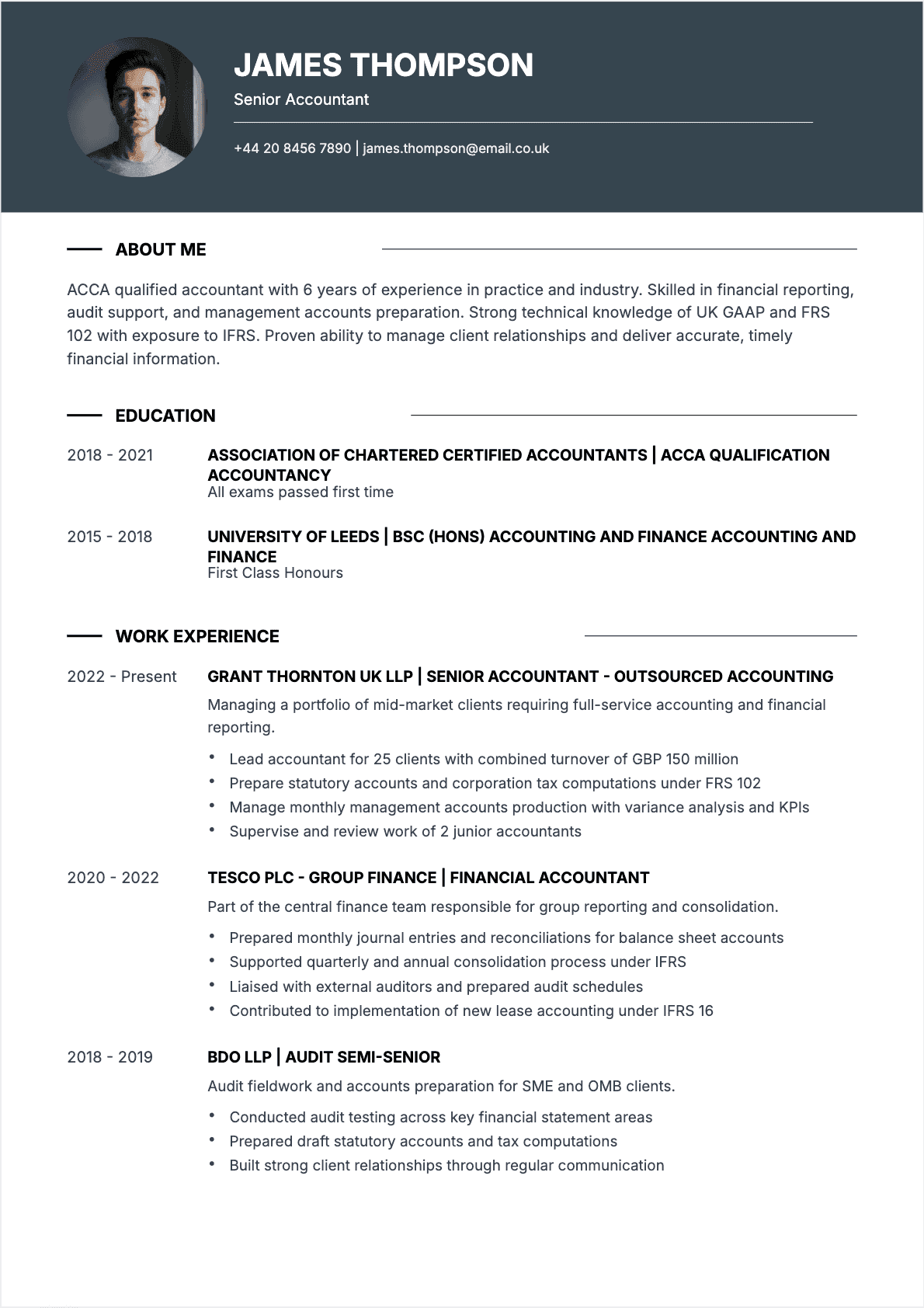

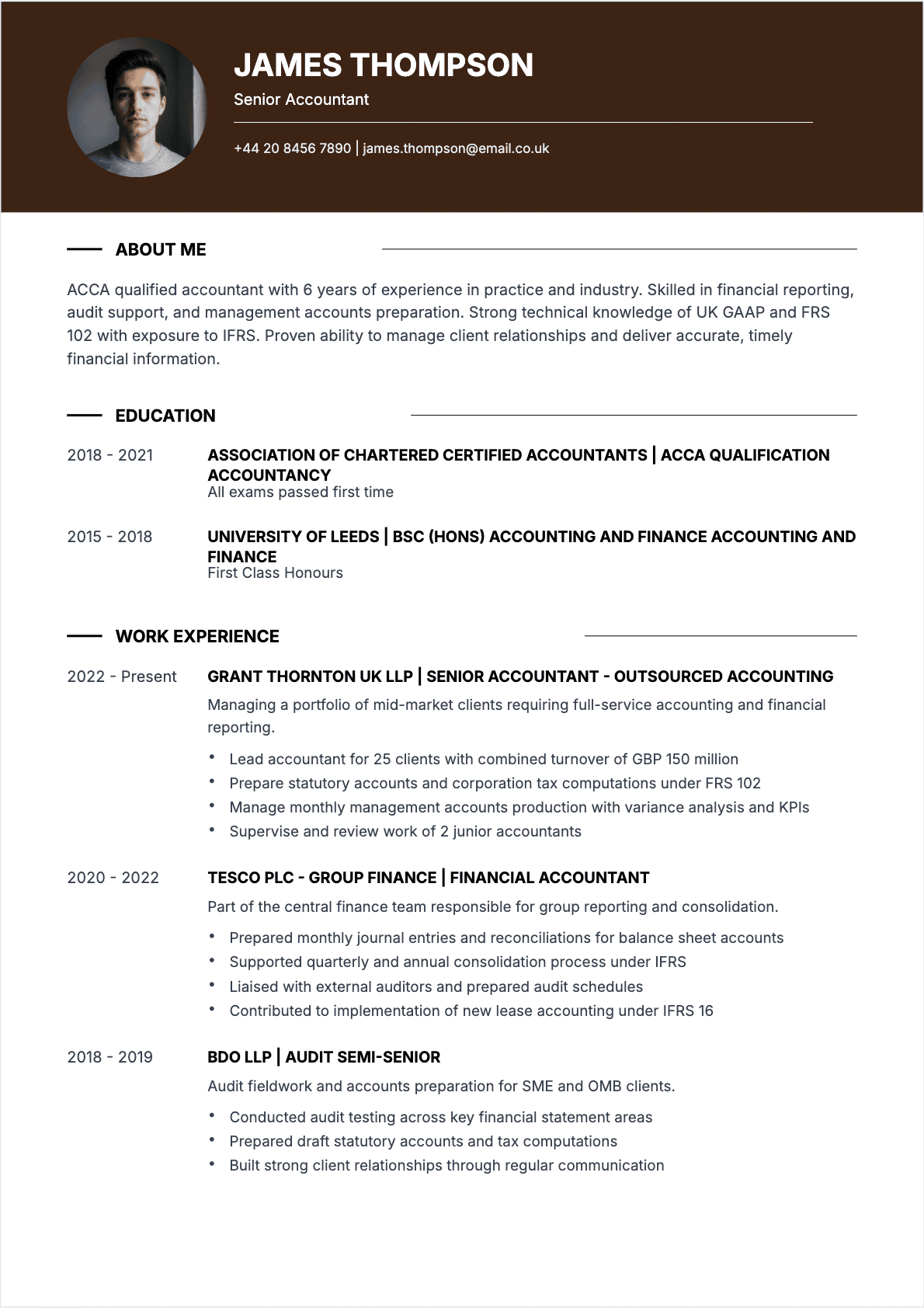

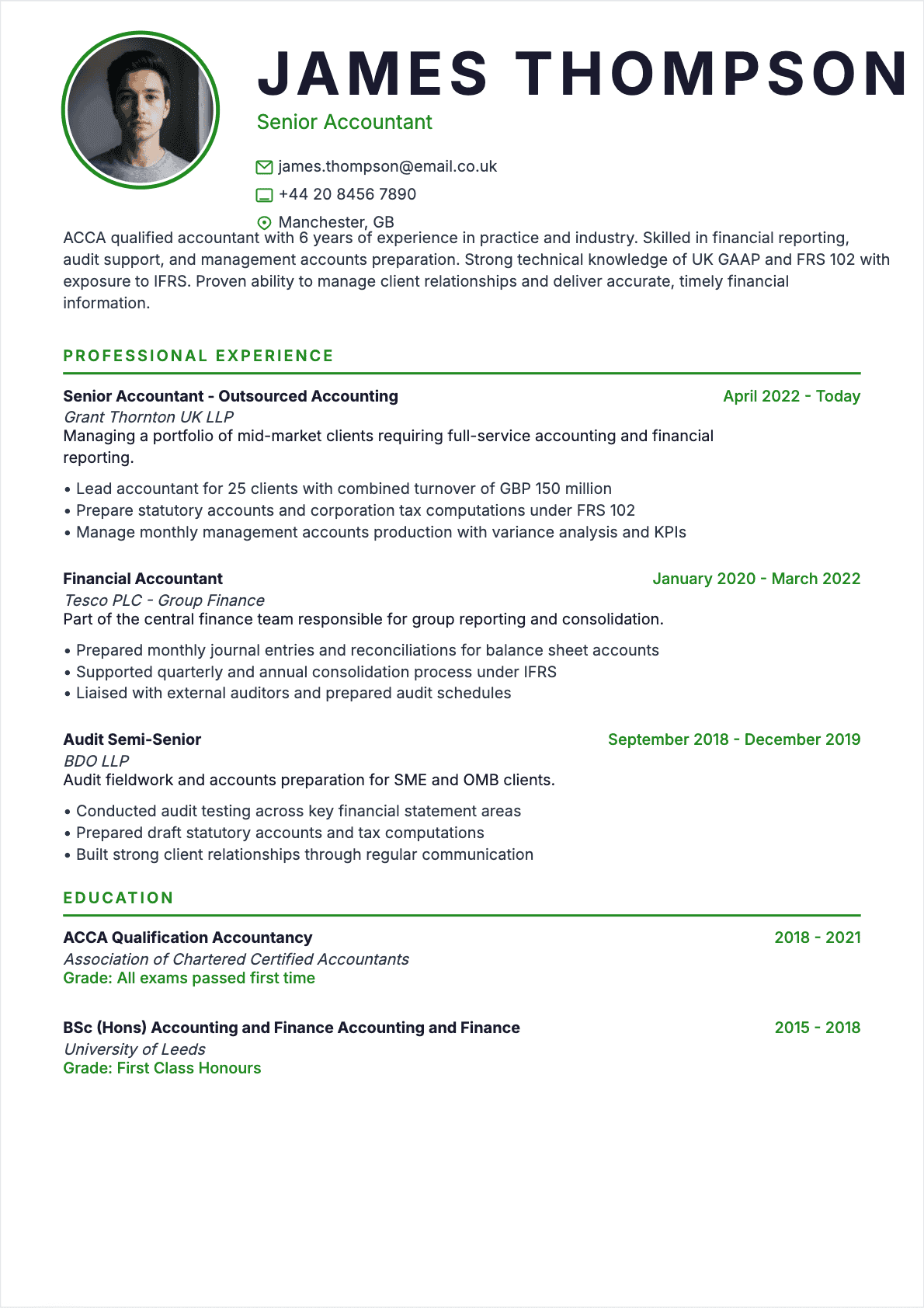

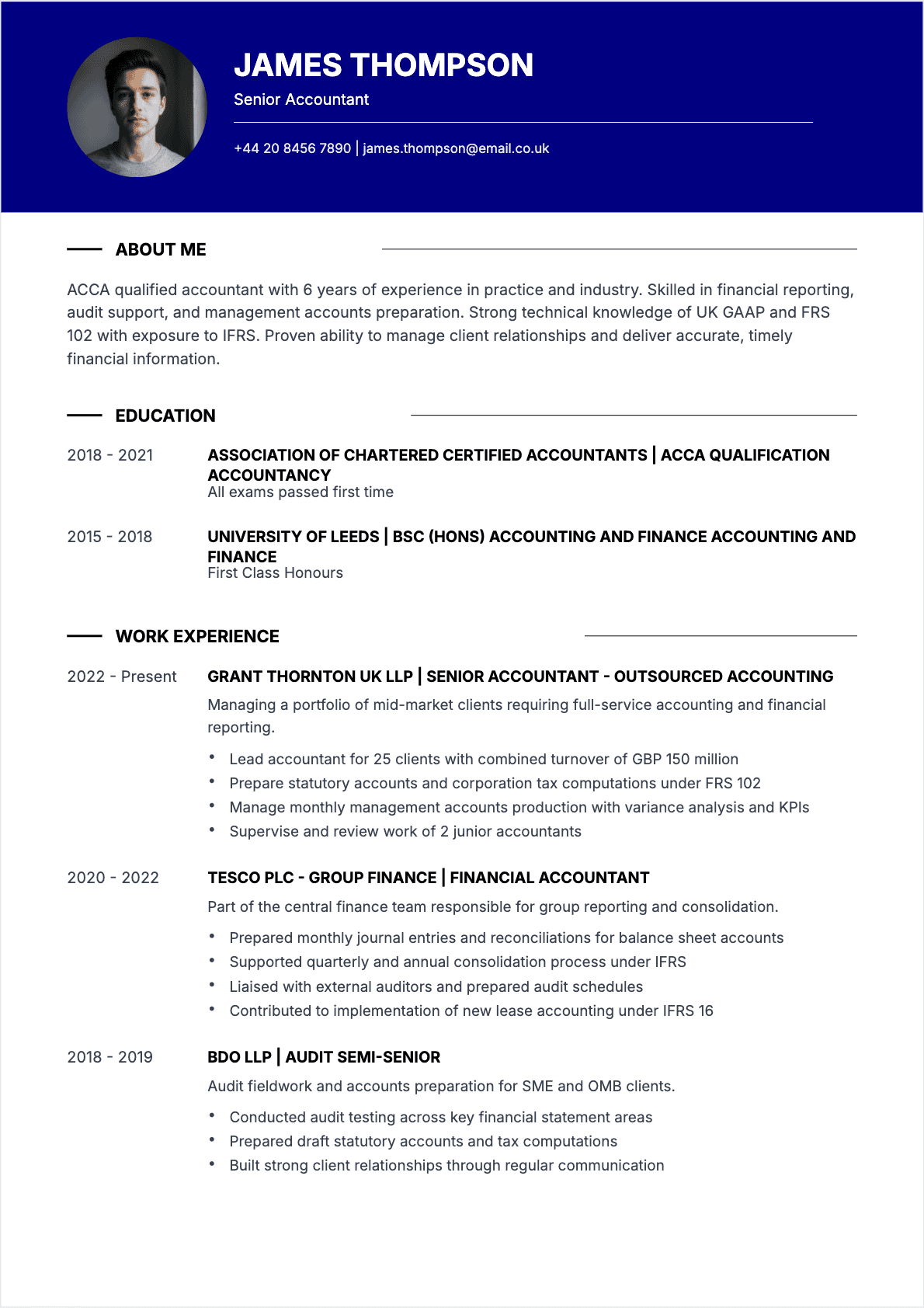

James Thompson

Senior Accountant

james.thompson@email.co.uk

+44 20 8456 7890

Manchester, GB

ACCA qualified accountant with 6 years of experience in practice and industry. Skilled in financial reporting, audit support, and management accounts preparation. Strong technical knowledge of UK GAAP and FRS 102 with exposure to IFRS. Proven ability to manage client relationships and deliver accurate, timely financial information.

Work Experience

Senior Accountant - Outsourced Accounting

Grant Thornton UK LLP

- ●Lead accountant for 25 clients with combined turnover of GBP 150 million

- ●Prepare statutory accounts and corporation tax computations under FRS 102

- ●Manage monthly management accounts production with variance analysis and KPIs

Financial Accountant

Tesco PLC - Group Finance

- ●Prepared monthly journal entries and reconciliations for balance sheet accounts

- ●Supported quarterly and annual consolidation process under IFRS

- ●Liaised with external auditors and prepared audit schedules

Audit Semi-Senior

BDO LLP

- ●Conducted audit testing across key financial statement areas

- ●Prepared draft statutory accounts and tax computations

- ●Built strong client relationships through regular communication

Education

ACCA Qualification

Association of Chartered Certified Accountants

BSc (Hons) Accounting and Finance

University of Leeds

Skills

Languages

English — Native Speaker

Spanish — Intermediate

Certifications

ACCA Member (FCCA pending)Association of Chartered Certified Accountants

IFRS CertificateICAEW

Further reading:

Frequently asked questions

Find answers to the most frequently asked questions.

Aim for one page if you have under 5 years of experience, and two pages if you have 5+ years or multi-entity scope. Prioritize recent roles and quantify impact (close timeline, reconciliations, audit outcomes). Remove repetitive task bullets and keep a compact skills/tools section.

In the US, avoid adding a photo; it is not expected and can create bias concerns. In the UK it is usually optional, but still uncommon in finance. Use the space for keywords, tools (SAP/NetSuite), and quantified outcomes (close D+6, reconciliation completion rate).

Use keywords that match the job description and your real experience: month-end close, general ledger, journal entries, accruals, prepayments, balance sheet reconciliations, AP/AR, IFRS or US GAAP, audit support, and your ERP (SAP FI, NetSuite, Dynamics 365, QuickBooks).

Use operational finance metrics: close cycle time (D+8 to D+6), reconciliation on-time rate (80% to 96%), number/value of aged items cleared (e.g., £310k), reduction in manual journals (e.g., -30%), fewer audit adjustments, or fewer posting errors after controls were implemented.

Not always. Many roles accept a Bachelor’s or Master’s degree plus relevant experience in close and reconciliations. However, ACCA/ACA can significantly improve shortlisting, especially for UK roles, audit-heavy environments, or promotion tracks. If you are part-qualified, state papers passed and expected completion date.

Avoid vague labels like “advanced.” Instead, list specific functions and outcomes: Power Query for data cleansing, PivotTables for reporting packs, XLOOKUP for mapping, and templates for recurring journals. Add a line showing scale (e.g., automated 14 journals; built a monthly pack used by 6 stakeholders).

Your career deserves a better resume

With CVtoWork, select a template, fill in the fields and download your resume as PDF.

Start creating